Ever since the pandemic began in spring 2020, I’ve been trying to learn the ins and outs of investing in stocks in order to generate a passive income stream for my family’s future.

I’ve invested in a Motley Fool subscription and read through every article about growth and dividend stocks that come into my feed, from titles ranging from “3 Dividend Stocks You Need to Invest $1,000 Into Right Now,” to “Buy and Hold On To These 5 Growth Stocks Forever”. And the one principle for investing for maximum benefits is always the same: keep investing.

On the flip side of that on the employment spectrum is the Dip. The Dip is a concept from entrepreneur and author Seth Godin that addresses the practice of successfully quitting at the right time. According to Godin, systems have been put in place that encourages us to quit, and he calls the common sinkhole that we all have to fight through, but regularly trips so many people up–you guessed it–the Dip. In the very first page of his book, Godin writes:

In fact, many professions and many marketplaces profit from quitters–society assumes you are going to quit. In fact, businesses and organizations count on it.

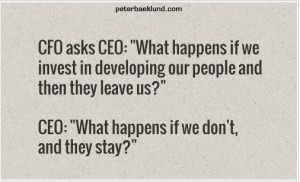

With all the resources employers possess for recruiting and retaining top talent–from ATS screening systems, recruiting services and LinkedIn to health benefits, remote work and new parent leave–one would believe that they would be better fit and educated to keep investing in the vocational growth, development and longevity of their team rather than sticking with the old systems and anticipate their resignation.